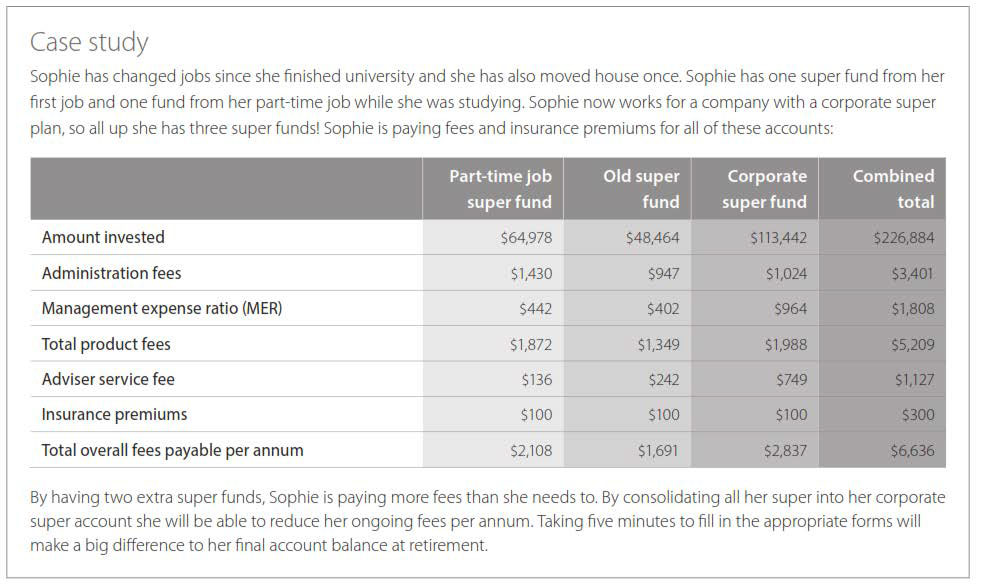

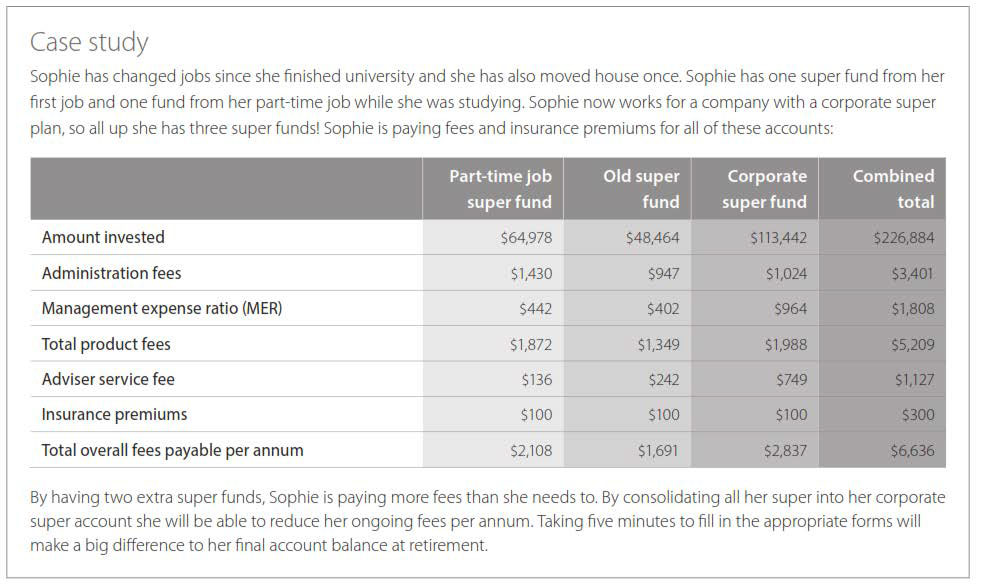

How many super funds do you have? Chances are you are probably not keeping track of where your super money is invested. In fact, you could even be losing money right now. Consolidating all your super into one account puts you back in control of your retirement savings and it will save you account-keeping fees.

If you have changed jobs, changed your name or moved house, chances are you may have lost track of where your super is invested.

The Australian Taxation Office (ATO) estimates lost superannuation to be worth around $14 billion as at 30 June 2016.1

By tracking down and consolidating your super accounts, you will save having to pay multiple sets of administration fees. Over the years, this could add up to thousands of dollars towards your final superannuation benefit.

Benefits of consolidating

- Reduced fees: paying only one administration and/or member fee means additional fees are not eating away your retirement savings. For example, if you’re paying $5 per month in member fees on three different accounts, you’re paying at least $180 per year in member fees.

- It’s easier to keep track of the growth of your super savings by having your contributions go into one fund. What’s more, you’ll receive only one statement or fund update, meaning less paperwork to manage.

- It allows you to develop a focused and effective retirement investment strategy, as you don’t have a number of neglected, smaller accounts that you lose track of, which get eaten away by fees and inflation.

What should you do if you’ve lost track of your super accounts? Lost super refers to super accounts where the member has simply forgotten about their account, or their fund has lost track of the member’s contact details. In some instances, there may be super accounts in your name that you didn’t even know existed.

In Australia, complying super funds (funds which meet certain Government requirements) are required by law to notify the ATO of lost members.

A member becomes lost when two written communications are returned to the super fund unclaimed. Lost members’ details are given to the ATO and their account balance is held by the super fund until claimed or, depending on the balance, it can be transferred to an eligible rollover fund.

If you’ve lost track of one of your super accounts, you can start by calling the ATO’s superannuation help line on 13 10 20 and choose the lost members’ register option or visit www.ato.gov.au/superseeker Make sure you have your tax file number handy. Your financial adviser can also help you track down your super and consolidate it.

Things you should consider

Life insurance

Your existing super fund may include life insurance, income protection insurance or other personal insurance. If you want to maintain the same or a greater level of insurance, check with your new super fund if this cover can be established before closing your existing super fund otherwise you may be in a position of having no insurance cover.

Time out of the market

It generally takes several weeks to close an existing super fund and transfer the funds to a new super fund. This is because the underlying investments in your existing super fund have to be sold and underlying investments in your chosen super fund purchased. During this time, a portion of your funds are likely to be invested in cash rather than your selected assets. This means if the value of your selected assets rise you won’t get the full benefit, but if the value drops, you would receive a better return from the cash investment.

Fees and costs

All super funds charge fees. The fund’s product disclosure statement outlines the fees and costs associated with exiting your super fund.

Your financial adviser is not limited to any one superannuation provider; they can, therefore, provide you with advice on a range of superannuation funds and will always look to provide you with the most appropriate fund for your specific needs.

TaLK to TLK

TaLK to TLK