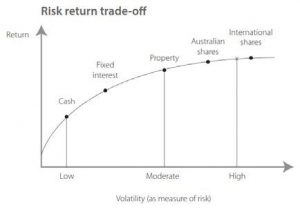

Risk Versus Return

This information is of a general nature only and does not take into account your particular objectives, financial situation or needs. Accordingly the information should not be used, relied upon or treated as a substitute for specific financial advice. Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither TLK Wealth Pty Ltd nor its employees, associated entities or agents shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information. TLK Wealth Pty Ltd is authorised representative #1007998 of MyPlanner Professional Services Pty Ltd AFSL #425542.

TaLK to TLK

TaLK to TLK